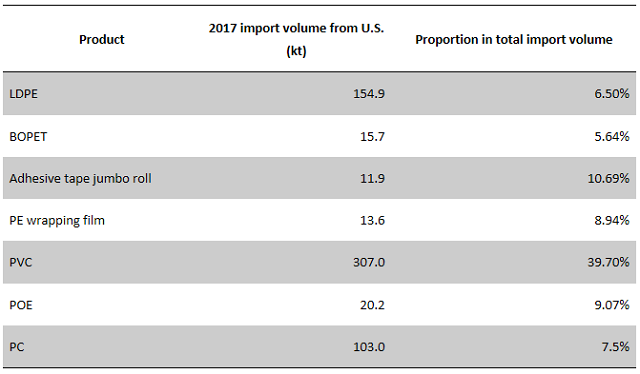

The Ministry of Commerce of China has announced that it will impose 25% tariffs on imports of agricultural products, automobiles, chemicals and aircraft from the U.S. Final measures and effective time will be announced separately. By marshalling the list, the related plastic products are LDPE, PVC, PC, POE, BOPET, PE wrapping film and adhesive tape jumbo roll.

BOPET, PE wrapping film and adhesive tape jumbo roll are the downstream products. The supply of these products is ample in China, and the import volume from U.S. is small. Thus the impact of 25% tariffs on these products will be small.

LDPE, PC, PVC and POE are upstream materials. Although POE is totally dependents on imports in China, the major import origins are Thailand, Singapore and South Korea. The import volume from the U.S. is small and unstable. Thus the influence of tariff on POE will be small.

China imported 307kt of PVC from the U.S. in 2017, taking up 39.7% of the total PVC import volume. However, China has imposed anti-dumping duties on PVC from the U.S. for many years. Most imported PVC from the U.S. is via the trade mode of processing trade with imported materials and processing and assembling trade provided with raw materials. Thus the influence of tariff on PVC will be small.

At present, the LDPE resources from the U.S. have strong price advantages. The trade mode is mainly general trade. After imposing 25% tariffs, the prices of imported LDPE from the U.S. will exceed the mainstream LDPE prices in China obviously. It is estimated that the traders will stop trading with the U.S. LDPE producers in the future. China imported 154.9kt of LDPE from the U.S. in 2017. However, the U.S. is not the largest import origin. The largest import origins are Iran, Saudi Arabia, UAE, Qatar and South Korea.

No comments:

Post a Comment